Rapid Finance on 11 January 2022. 6 Safely Show Your Car.

How To Refinance Your Car Loan The Ultimate Guide Rategenius

Most subprime lenders want to see that you have between 1500 and 2000 in pre-tax monthly income to qualify you for low-income auto loans.

. Offering The Lowest Rates And Treating Customers Fairly Since 2007. If youre unemployed and dont qualify for a loan there are still ways you can start to plan financially. A down payment reduces the total amount you can finance and a large down payment can save you money on your loan.

If youre relying solely on. 2 Get Ready to Sell Your Car. Ad Celebrating 12 Years Of Professional Friendly Advice.

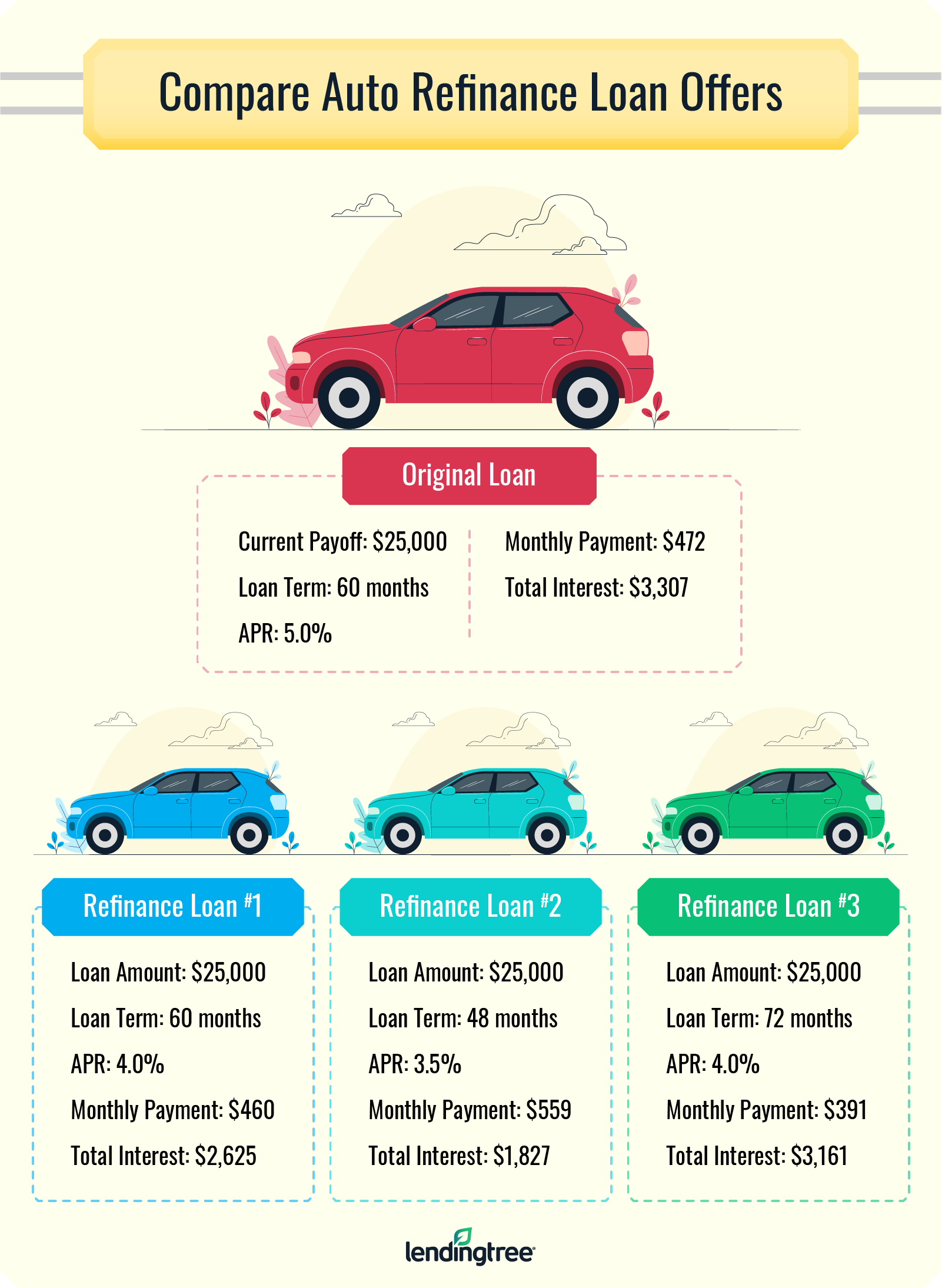

For example using the LendingTree auto loan refinance calculator suppose you were a year into a. This department has the authority to approve a mortgage refinance. In order to jointly apply for an auto loan lenders typically require a co-borrower to be a spouse.

Income Is a Must. Pay all relevant fees or add them to the amount of your loan. 3 Get Your Vehicle Ready to Sell.

Ad Celebrating 12 Years Of Professional Friendly Advice. 5 Advertise Your Car. The Best Reason to Refinance.

September 3 2009 700 AM. 550 credit score no open bankruptcies 24000 annual income US citizen or permanent resident 18 years old. Consider applying for prequalification.

The ability to borrow at a lower interest rate is a primary reason to refinance a loan. If you dont have traditional W-2 income you have to have taxable income that. The Bottom Line.

As someone who has been without a full-time job for more than a year Ive wondered how to refinance my home while being unemployed. That lower rate assuming all other factors. For instance lets say you qualify for a fixed 6.

Youre not automatically excluded from getting an auto loan without a job. Sorry to hear about your job loss. Call your lender and ask to speak to the Loss Mitigation Department.

Apply for an auto refinance loan. The borrower gets a new loan agreement possibly from a different lender. Pay off your old loan and start making new monthly payments.

Read your new loan documents. But with a new car loan refinance you can hopefully save money to weather the storm. When you jointly apply for a car loan both you and your spouse agree to take.

Theres a general assumption that finance lenders wont offer car loans to the unemployed. You Can Get A Mortgage Or Refinance Without A Traditional Job Acquiring or refinancing a mortgage when youre unemployed is tricky but not impossible. Explain your situation and ask.

While this may seem like a lot of. Answered on Oct 19 2021. And theres a fairly understandable.

Get up to four offers in minutes. If you cant make payments. One thing to keep in mind is the earlier you refinance the more you can save.

Evaluate bills and take steps to reduce expenses. The principal borrower can refinance the auto loan in their own name to remove the cosigner. 4 Set the Right Price.

Complete the refinancing process once youve found a lender willing to accept you. If you default on a HELOC however you can lose your home. Offering The Lowest Rates And Treating Customers Fairly Since 2007.

If you own your car outright you dont owe any payments on it you can use it as collateral on a loan. 1 Decide How to Sell Your Car.

How To Refinance Your Car Loanfivecentnickel Com

Update Auto Refinance Rates Drop After Federal Reserve Reacts To Coronavirus Rategenius

Can I Refinance My Car Loan Without A Job Rategenius

How To Get A Car Loan With No Credit History Lendingtree

Can I Refinance My Car Loan Without A Job Rategenius

How Soon After Purchase Can You Refinance A Car Lendingtree

0 comments

Post a Comment